Individuals & Families

Your Personal CFO

Consolidate, Simplify & Strengthen your financial life

Overview

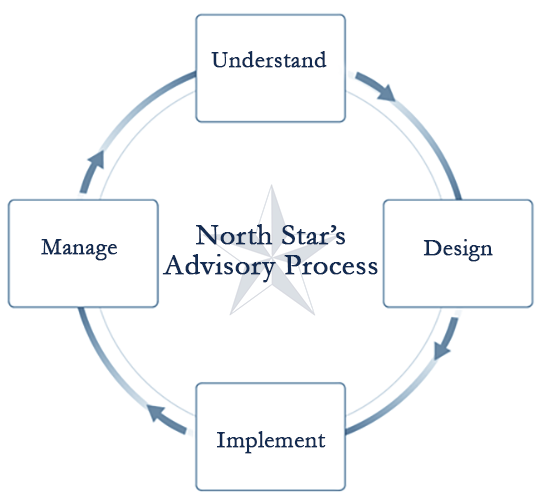

We can help break down the financial planning process into the following steps:

Services

Understanding your needs

North Star begins by getting to know you and your family while gathering information about your current circumstances, future goals, concerns and aspirations. During this phase, North Star will also discuss the strategies and services available to help solve the specific financial challenges you face.

Step 1: Establishing a relationship

At North Star, we feel that the establishing a good relationship with our clients is key to understanding their goals. We establish this relationship by having an initial meeting to find out our clients’ short, intermediate and long-term goals.

Step 2: Gathering information

After we have established our relationship, we will ask you to complete or provide the following documents:

- Data Collection Sheet

- Expense Sheet

- Risk Tolerance Questionnaire

- Estate Planning Sheet

- Employer Benefits

- Social Security Statement

- Any other documents that pertain to your financial life

Designing a comprehensive plan

Depending on your circumstances, your plan may focus on a single objective or a more complex strategy.

Your plan could be as singular as saving for retirement or a child’s education, managing a concentrated equity position, or establishing a trust to benefit a child with special needs.

More complex plans may include purchasing or selling businesses, establishing charitable trusts or joining investable assets to deliver the income you need to retire comfortably.

Step 1: Review scopes of services

After we learn your goals and gather your information, we will review and establish what services you would like North Star to provide. These can include but are not limited to:

- Cash Management

- Fixed Income & Bond Ladders

- College Planning

- Retirement Planning

- Life & Long-term Care Insurance

- Health & Disability Insurance

- Home & Auto insurance

- Estate Planning

- Consulting Services

Step 2: Analyze and evaluate needs

Once we have identified what services we will provide, we will analyze your exact needs as they relate to those services. We will make specific recommendations by:

- Analyzing the different solutions that are available

- Evaluating those different solutions based on your needs

- Providing you with specific proposals on the different options

- Reviewing the pros and cons of each option with you

Step 3: Choosing the right plan

After looking through the pros and cons of each option, the next step is to choose the plan that best fits your needs by:

- Establishing which solution you want to implement

- Deciding what third party providers will be necessary to implement the plan if applicable

- Finalizing selection of right product if applicable

Implementing your plan

In this phase, the planning is put into motion while collaborating with other relevant professionals as needed – which may include your attorney or CPA. The plan is based on your goals uncovered in previous steps of the advisory process and factors in your investment horizon, as well as the types and levels of risk that you can afford and with which you’re comfortable.

Step 1: Account setup

- Filling out paperwork associated with establishing accounts and/or insurance.

- Initiating the transfer process for assets currently held at other financial institutions.

- Ensuring you have received prospectuses, research reports and required disclosures.

- Auditing the transfer process to ensure a smooth transition.

Step 2: Asset allocation and product implementation

- Determine the proper asset mix for each account based on the time horizon for the account and your risk tolerance.

- Implementing any products, like life insurance, after they have been approved.

- Running cash flow projections to determine if you are on track to reach your goals.

Managing your plan once it’s in place

Financial planning is an ongoing process in which it’s essential to monitor the progress of your investments within the context of your goals and periodically review all relevant information. It may become necessary to adjust the particular components of your plan in light of changing circumstances and evolving objectives. Should economic and financial circumstances warrant, your advisor may also recommend tactical changes to your portfolio, while still adhering to your long-term goals.

Step 1: Plan management strategy

- Establishing a consistent schedule for monitoring plan performance.

- Establishing consistent criteria for evaluating plan performance.

- We will continually educate our clients on what is going on in the markets and how products and services work.

Step 2: Plan management

- We will meet on a consistent basis to review the different aspects of your plan.

- Make any changes that are necessary to meet your goals.

- Update goals if they have changed.

- Add new goals as they come up, for example, you may adjust your plan after the birth of a child.

- Document all meeting notes in a summary review email, which will list out tasks for both the advisor and the client.

- Possible meetings with other professionals like an attorney or CPA, to make sure that your plan is being implemented in all facets.

Why North Star Advisory Group

There’s something more powerful than luck or coincidence to help bring financial independence within reach – planning.

As professionals dedicated to continuing education and a high standard of ethics, we leave nothing to chance. We coordinate with other trusted professionals to ensure seamless management of your assets with services that range from portfolio management, insurance, tax, estate, retirement planning and beyond.

The result is a unique plan that has the underpinnings of knowledge required to carry it forward, a plan that is thoroughly researched and vetted, yet flexible and responsive to life’s many transitions.